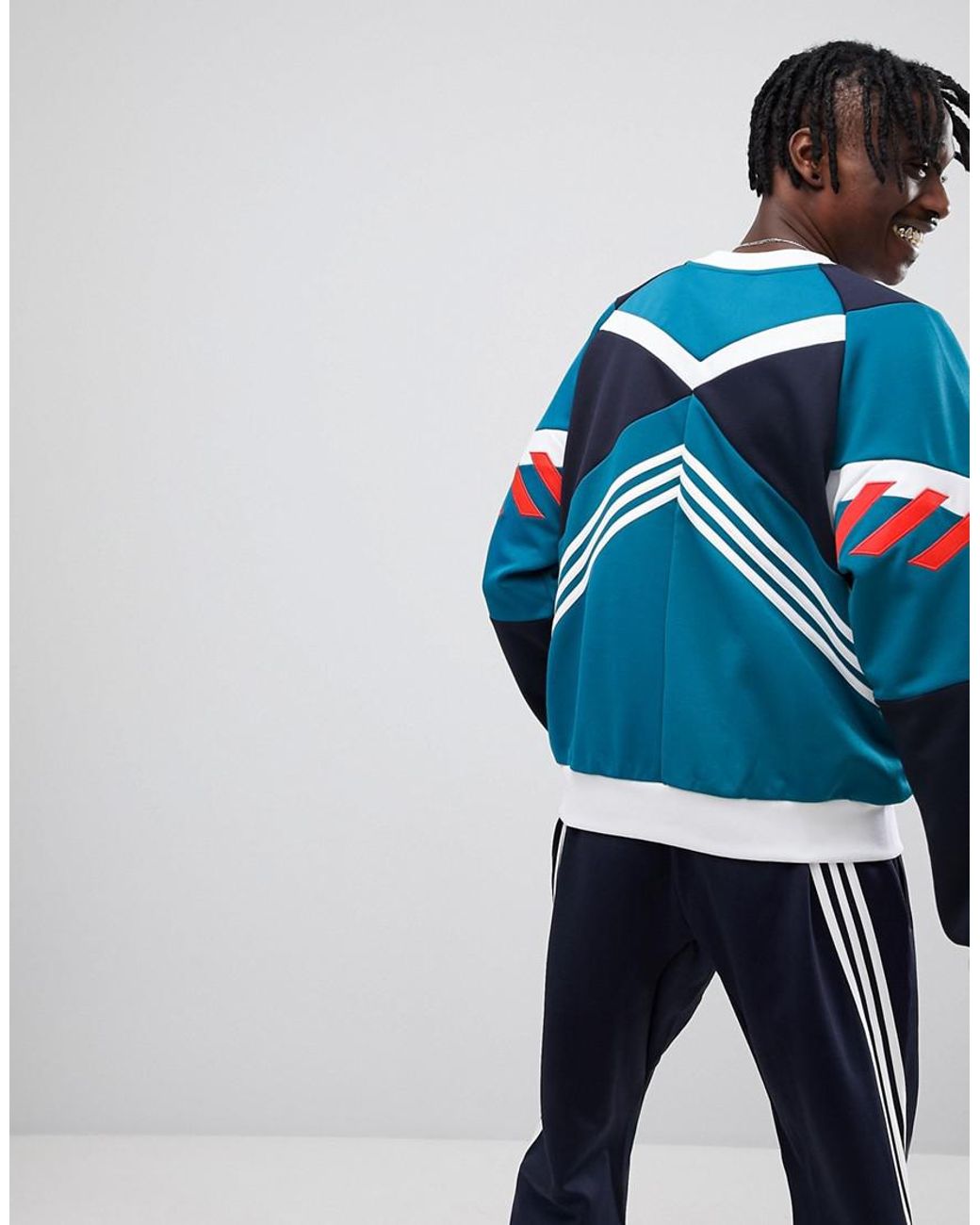

adidas Originals Nova Colourblock Sweatshirt | ASOS | Color block sweatshirt, Sweatshirt fashion, Casual outfits

Buy ADIDAS Originals Men Blue & White Colourblocked Nova Wind Joggers - Track Pants for Men 2419689 | Myntra

Adidas Originals Nova Retro Oversized T-shirt In Gray Ce4844 - Gray | ModeSens | Oversized tshirt, Adidas originals, Retro tshirt